Can I get the Age Pension? – is a great question to ask when you are ready to retire. Because when you are eligible for age pension it slows the draw down on your retirement investments.

As financial advisors that specialise in retirement planning, we actively help our clients identify when they can get the age pension. We also consider strategies that can increase age pension entitlement, where they make sense.

In this blog, we explain the rules and tests you must meet and pass in order to receive the Age Pension.

Why The Age Pension is So Important For Australians

Age pension is available to all Australian’s that meet eligibility requirements. Its a safety net, that helps ensure you can afford a minimum standard of living in retirement.

Pension payments are made fortnightly and indexed annually, to keep pace with wage and cost increases. To get the age pension you must meet a residency rule, an income test, and an asset test, which we cover.

To illustrate why you are smart asking ‘can I get the age pension?’, approximately 63% of Australian retirees receive either a full or part age pension currently. This is according to Rice Warner and shows how important age pension is to most retirees. What’s more, there are financial planning strategies you can employ to maximise age pension too.

Can I Get The Age Pension?

To be eligible for the Age Pension, you generally need to be an Australian resident and have been so for the past 10 years.

For 5 of those years, you need to have had no break in your residence in Australia. You may need to establish your Australian residency with a Residence in Australia and other countries form.

There are some other considerations that would still allow you to receive the Age Pension, such as being a refugee, having a partner die who was an Australian resident and you have lived here for less than 10 years, or lived and worked overseas in an agreement country.

When determining how much Age Pension you are eligible to, an income and assets test is applied. Both tests are calculated and whichever results in a lower pension entitlement, is the one that is applied. This is how they work.

Income Test

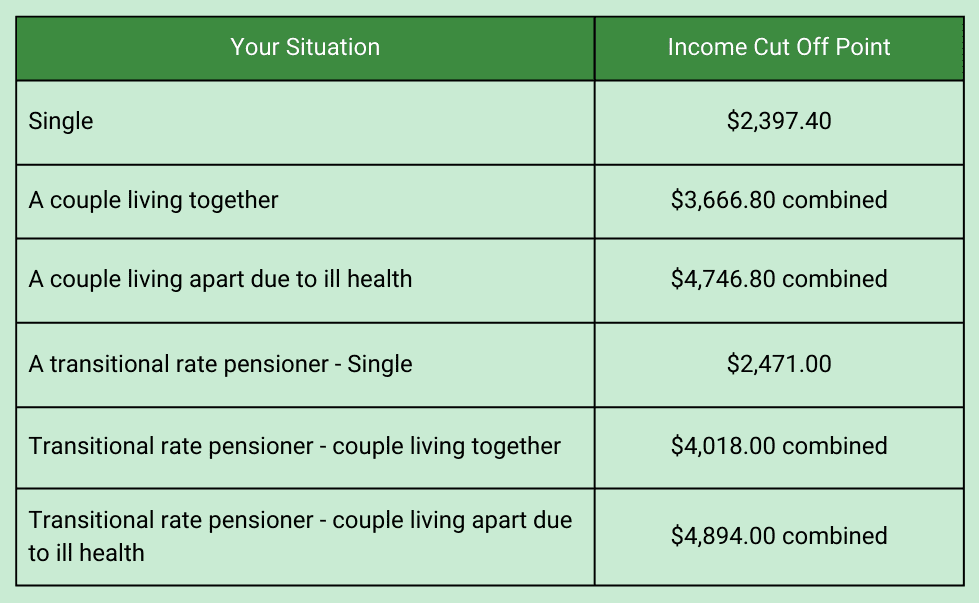

The income test is an assessment of the income you generate or are deemed you ought to generate from Centrelink. There is a sliding scale of income you are allowed to earn, without impacting your pension entitlement. However when you earn more than the upper threshold (illustrated below), you will not be eligible to any age pension at all.

To assess your income, Centrelink consider all sources of income that you and your partner have. This includes employment income, if you are still doing a little bit of work. But also all financial assets, like; superannuation; personal investments; trusts, company or private businesses interests. Depending on the income source, Centrelink may deem what income you should be earning too. This is called deeming and can work for you or against you, depending on the actual income you are receiving.

The below income tests are the standard rules for the Age Pension. This could be different based on your personal circumstances, so it is best to have a financial advisor scrutinise all the eligibility criteria for you.

Note that your cut off point could be higher if you are receiving Rent Assistance, or lower if you do not live in Australia.

Assets Test

The assets test is the other way Centrelink determine Age Pension entitlement. In our experience at Yield, it is also the test that generally impacts our clients first.

The assets test is a calculation of your assessable assets and whether you are in a relationship or not.

Assets include property or possessions you own in full, in part, or have an interest in. This includes anything owned outside of Australia and debts owed to you also.

Importantly there are exempt assets you should be aware of, like your principle place of residence, amongst several others. There are often strategies that can reduce your asset tested assets as well. So when determining ‘can I get the age pension’, these strategies should be factored in too.

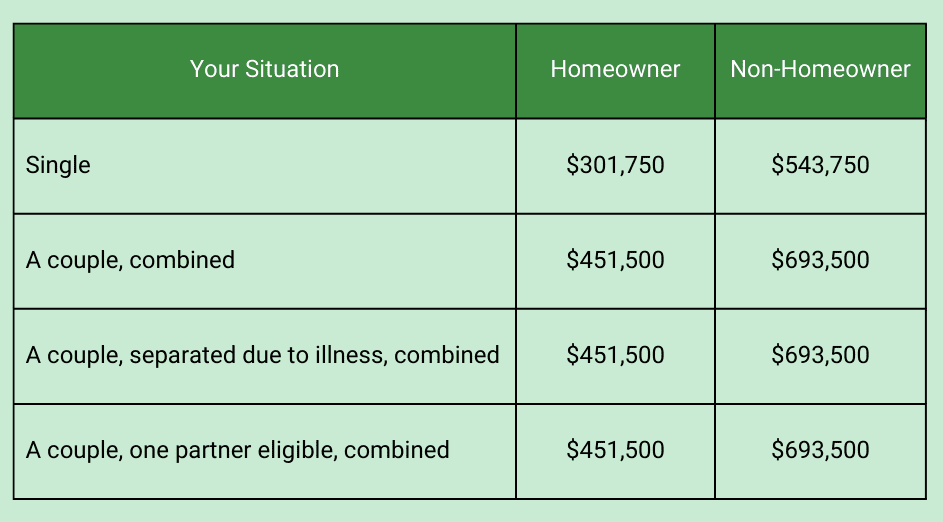

To receive the full Age Pension, your total assets cannot be over the below limits based on your personal circumstances.

Important to note, if you are a member of a couple, the limit is on yours and your partners combined assets.

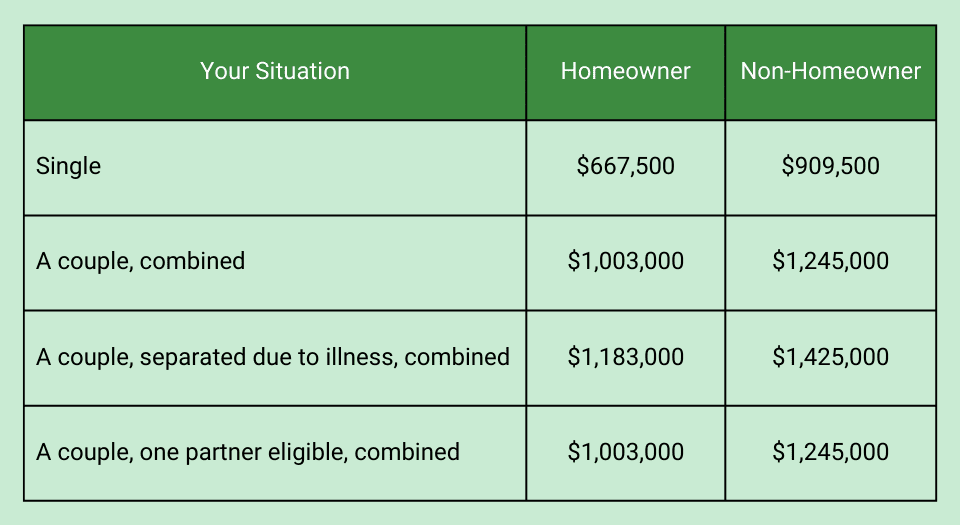

To receive the partial pension, your assets cannot be over the below limits.

As of September 20th 2023, your partial pension will be cancelled if your assessable assets exceed the following limits:

Age Pension Rates

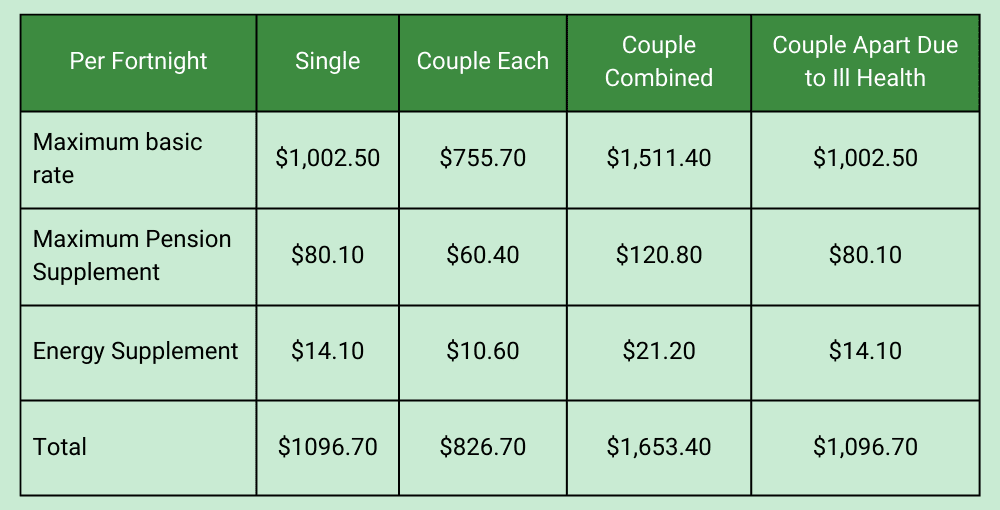

After your eligibility for the Age Pension is determined, the maximum age pension rates are noted below. There are additional supplements you may be eligible too, like for the cost of electricity. We have included reference in the table below to give you a full picture of what you could receive based on your personal circumstances.

Age pension eligibility is intended to be fairly clear cut, but some things can cause havoc on your Age Pension entitlements. An example we’ve seen of this is where there is an interest in a family trust. Even if none of the assets relate to you personally. Issues can arise similarly when there is interest in private companies/businesses, known as attribution rules. It can be quite complicated so if you do have an interest you should seek financial advice.

Financial Planning Advice Will Help

When you are assessing the question of “can I get the Age Pension?” there can be strategic and practical benefits of seeking advice. Strategically to work through how you structure your assets to maximise your age pension entitlement. And practically to work through the paperwork and policy Centrelink have, to make this process as smooth as possible.

Not only will a Financial planner be an advocate scrutinising what you will be eligible for. But they will also do projections that consider your retirement nest egg and social security payments to make your money stretch further.

At Yield we are retirement experts and Age Pension can be a big part of this. Please feel free to get in contact with one of our financial advisors for an obligation free discussion.