Get in touch with us

Book a FREE consultation and receive your complimentary eBook

Get started with a free strategy consultation and receive a copy of the Good Fortune Guide – written by James McFall, Managing Director Yield FP and 2020 National Finalist Certified Financial Planner of the Year to help educate you on your Financial Plan.

Book a FREE consultation and receive your complimentary eBook

Get started with a free strategy consultation and receive a copy of the Good Fortune Guide – written by James McFall, Managing Director Yield FP and 2020 National Finalist Certified Financial Planner of the Year to help educate you on your Financial Plan.

Insurance advisors evaluate your need to identify quality policies that are inexpensive compared to market. If you have existing cover, we will see if there is an alternative cheaper cover that also offers similar or superior value for your circumstances.

-

Income Protection

-

Life Insurance

-

Total Permanent Disablement

-

Trauma

Income Protection

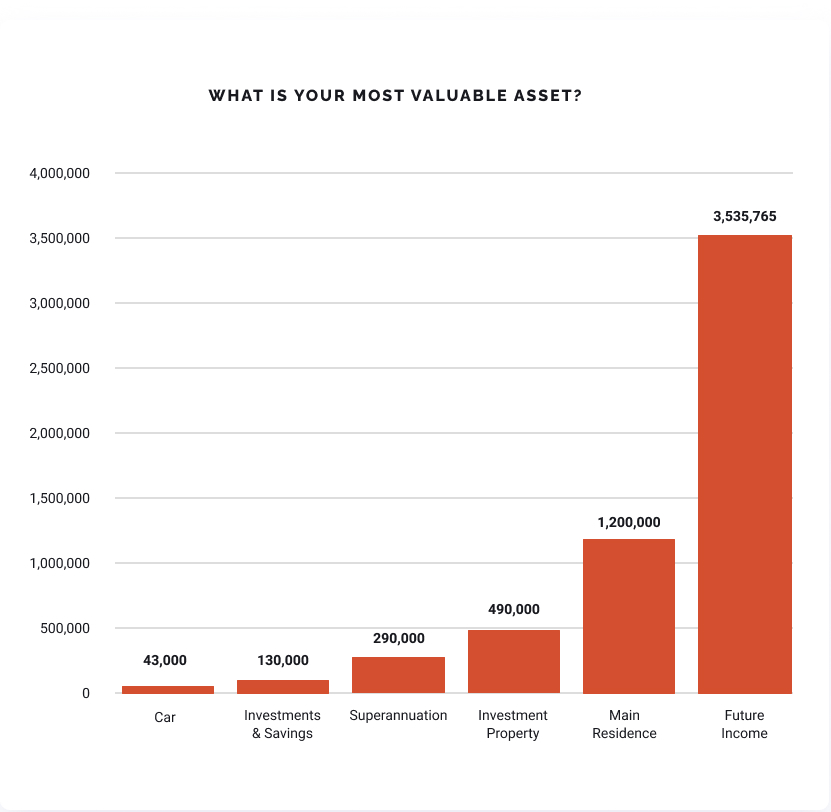

Being able to provide your family with an income is your most important financial asset. Because without your most significant income stream, necessary bills and household items become a lot harder to pay for in what can be a very stressful period.

This is why income protection insurance is such a vital part of your financial plan. It covers up to 70% of your wage if you are unable to work for medical reasons. Each policy is different, which is why we review the insurance market for a policy that is best suited to protect you for risks in your profession and lifestyle.

It is also tax deductible and becomes cost effective when looking at how it can protect your future financial safety.

Life Insurance

Life insurance could provide the safety cushion you want for your family that means they don’t have to worry about any financial implications of a tragedy.

We advise on the entire process for you from reviewing policies that are on the market, to showing you how to structure your life cover so it is paid from your “gross income” instead of “net income” to keep after tax costs as low as possible.

We also take charge of any claims process so you have to do as little as possible at this time.

Total Permanent Disablement (TPD) Insurance:

TPD cover provides you with financial security if you are permanently unable to work. This security extends beyond supporting your family’s income needs, but also looks after medical and rehabilitation costs and could also include costs you would not think of like modifications to your house, now needed for your circumstances.

Many people will already have this through their superannuation as it is often covered by default. However the cover levels may not be right for your financial plan and the protection can be very basic and therefore harder to claim on. This is why having our insurance advisors review what cover your financial plan needs can be so beneficial.

Trauma

Trauma insurance is there to protect you, if you suffer a serious illness or injury. It supports you and your family by funding medical and rehabilitation costs and gives you financial options at a vulnerable time. Quality contracts will cover you for illnesses like cancer, stroke, and heart attack.

You are your biggest financial asset!

Our financial plans are centred around what our clients want to achieve in their lives. Their goals are assisted by our financial plans and what we can see is attainable. To ensure this has the best chance of succeeding, even if you are no longer able to earn an income, we set you up with insurance that will always work towards your financial planning goals.

Your mortgage and investments for retirement are only able to be worked on if you earn an income. If this is taken away from you, what are your other options? We will ask you questions that identify what level of protection you want and then we listen. Understanding your needs allows us to apply our extensive knowledge of the insurance market to identify a level of cover that is right for you and your family, that is also cost effective and that is structured to maximise tax deductions.

Will Assist You With

Insurance advice and cover discussions can be very personal. Thorough analysis is needed to determine how much insurance you take out. To ensure you get the right level of risk protection for your needs, we take you through four easy steps.

Cover in line with your needs

We identify what you would like to happen if certain medical events were to occur, that could impact your ability to earn an income. We then take into consideration the assets you already have, that could be used to self insure some of your risk and help you calculate a suitable amount of cover.

Competitively priced policies

We review the market on price and identify cost effective policies. We use a market comparison software that WE PAY FOR monthly to assist and this ensures we’re taking a wide reaching search of the market options for you.

Policies that have good contracts

We filter the cost effective contracts against the quality contracts. The best policies for you will depend on your individual circumstances. Certain insurers are better for self employed people, for example, as they have more flexible ‘return to work’ definitions than others. Others we may favour for women for example, because the breast cancer definition is particularly good.

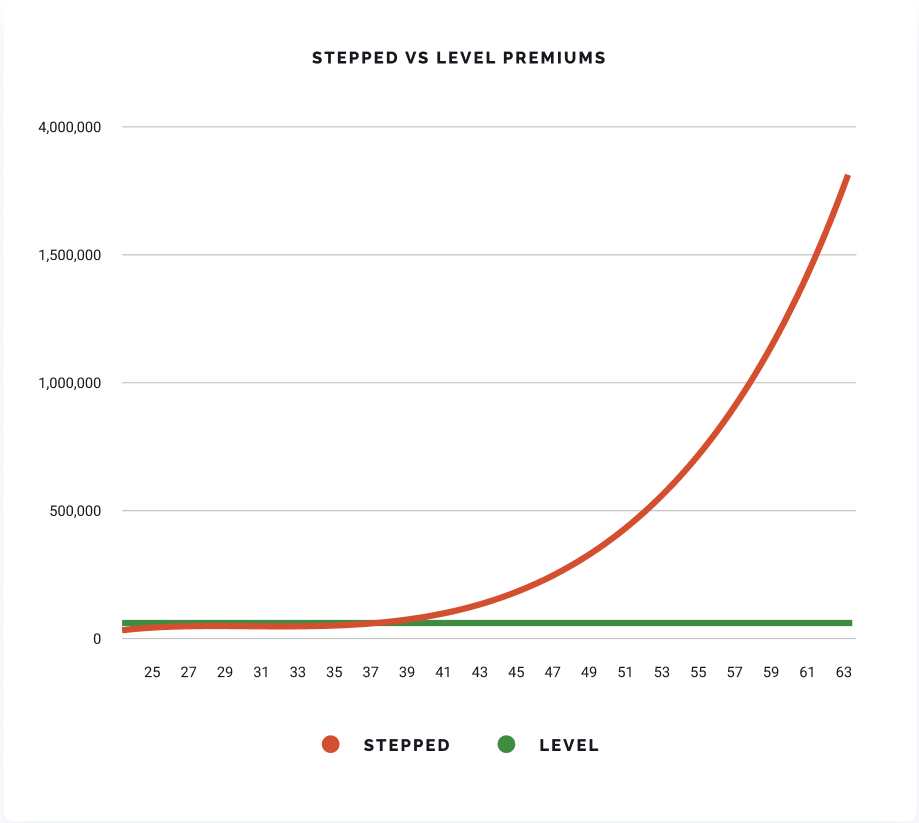

Correct policy structure

We see poor structuring of life insurance regularly, which means a higher NET cost. Our advice is very conscious of structuring your cover to deliver a low net cost.

How Yield Handles Your Insurance Policies & Reviews

Our insurance advisors will compare all policies to ensure you are protected to whatever degree you think is needed for your financial plan. We plan for you not having to pay a cent more than what you have to. We then assist clients with obtaining policies and assist them with any other step of the process.

Our insurance service is of most value when it is a part of our strategic ongoing service. We assess what your financial planning goals are and what insurance cover you will need in order to achieve these goals even if your health or personal circumstances take a downturn.

Choosing Yield ensures proactive advice, regular reviews and claims handling support, for your peace of mind.

Wealth Protection Strategies

Get In Touch

Interested to discuss something?

Have a question or comment?

Submit your details and we’ll be in touch.

Free Consultation

Get started with a free strategy consultation and receive a copy of the Good Fortune Guide – written by James McFall, Managing Director Yield FP and 2020 National Finalist Certified Financial Planner of the Year to help educate you on your Financial Plan.